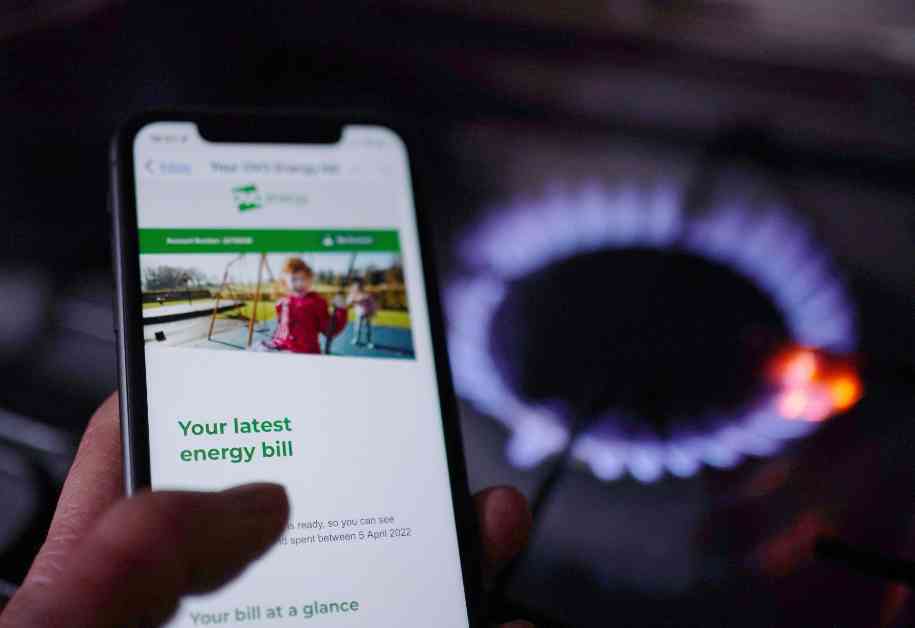

UK inflation has reached its highest level since April due to a spike in household energy bills, according to the latest official figures.

The Office for National Statistics (ONS) reported that the Consumer Prices Index (CPI) inflation increased to 2.3% in October, up from 1.7% in the previous month. This marks the sharpest month-on-month rise in inflation in two years.

Economists had predicted a lower reading of 2.2%, making this increase higher than expected for the month. The surge in inflation could potentially lead to the Bank of England delaying interest rate cuts.

The ONS attributed the rise in inflation to a significant increase in household energy costs. In October, average household energy bills went up by £149 per year after the energy regulator Ofgem raised the cap from £1,568 to £1,717 for a typical dual fuel household in the UK. This represented a roughly 10% increase.

Grant Fitzner, the chief economist at ONS, explained that the rise in inflation was mainly driven by the higher energy price cap, resulting in increased costs for gas and electricity compared to the previous year. However, these were partly offset by decreases in recreation and culture costs, such as live music and theatre ticket prices. Additionally, the cost of raw materials for businesses continued to decrease, largely due to lower crude oil prices.

The data also revealed that airfares saw a 6.6% increase in October compared to the previous month, contributing to the overall rise in inflation. On the other hand, transport inflation decreased as a whole, as lower motor fuel prices offset the increase in airfares.

With UK inflation surpassing the Bank of England and the Government’s 2% target rate, there may be pressure on policymakers to maintain interest rates following recent reductions. Despite recent rate cuts to 4.75%, the Bank of England has used high interest rates to control spending demand and lower inflation, which had peaked at 11.1% two years ago.

Monica George Michail, an associate economist at NIESR, forecasts that annual headline inflation will continue to rise towards the end of the year as base effects diminish. While rate cuts are expected to continue in 2025, the pace may be slower than previously anticipated, keeping rates elevated for a longer period.

Treasury Chief Secretary Darren Jones acknowledged the challenges faced by families across Britain due to the cost of living. He highlighted the government’s focus on economic growth and investment to improve living standards nationwide, building on the initiatives outlined in the recent Budget.

Overall, the latest inflation figures reflect the impact of rising energy costs on household budgets and the broader economy. As policymakers assess the implications of this increase, households may need to adjust their spending habits to cope with higher prices in the coming months.