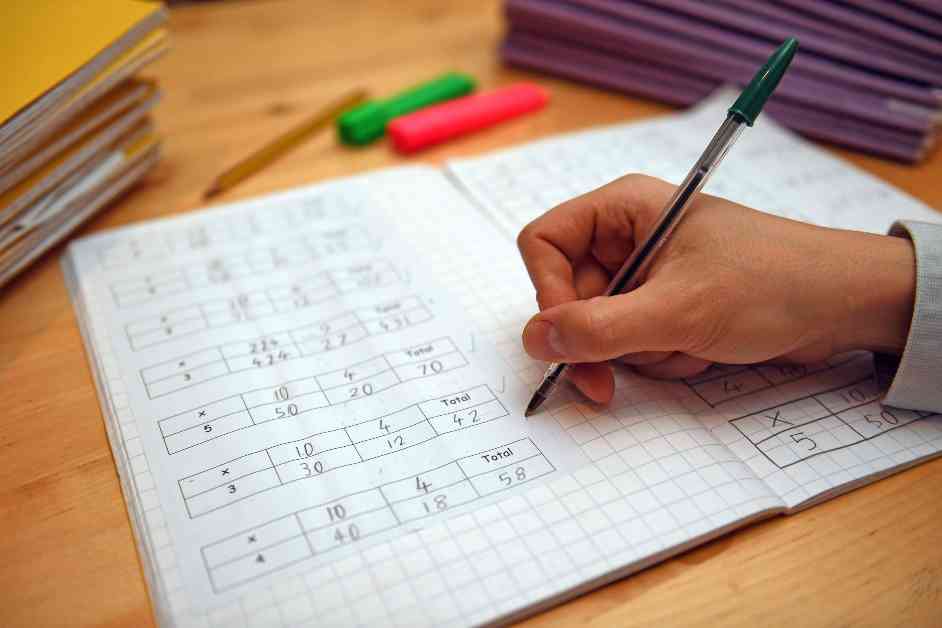

Financial Literacy Gap in Scotland

Financial education in Scotland’s curriculum primarily focuses on maths and numeracy, leaving many students without essential knowledge about managing finances. This gap results in individuals lacking the skills needed to navigate the complexities of the modern economy, such as opening a bank account, understanding interest rates, and applying for loans.

Impact of Financial Illiteracy

Recent research by Scottish investment group abrdn revealed the detrimental effects of poor financial literacy across all socio-economic classes. Lower earners with low financial literacy have significantly less saved for retirement compared to their financially savvy counterparts. This disparity underscores the importance of equipping individuals with financial knowledge to secure their future financial well-being.

Young Enterprise Scotland Faces Setback

Young Enterprise Scotland, a prominent organization dedicated to providing financial education to students, recently announced significant cutbacks due to funding challenges. The loss of more than half of its staff will limit the organization’s ability to deliver crucial financial literacy programs to students across the country. This setback highlights the vulnerability of financial education initiatives in Scotland and raises concerns about the future provision of essential financial literacy resources.

Amidst the holiday season, the impact of these cutbacks on the affected staff members adds a somber note to what should be a festive time. The uncertainty surrounding the survival of Young Enterprise Scotland’s programs further underscores the challenges faced in ensuring widespread access to financial education for students.

As we reflect on the importance of financial literacy in shaping individuals’ financial futures, it becomes evident that collective efforts are needed to bridge the gap in financial education. The developments at Young Enterprise Scotland serve as a poignant reminder of the ongoing work required to equip individuals with the knowledge and skills necessary to make informed financial decisions. In a rapidly evolving economic landscape, investing in financial education is crucial for empowering individuals to secure their financial well-being and build a more financially literate society.